Easy steps to get a loan

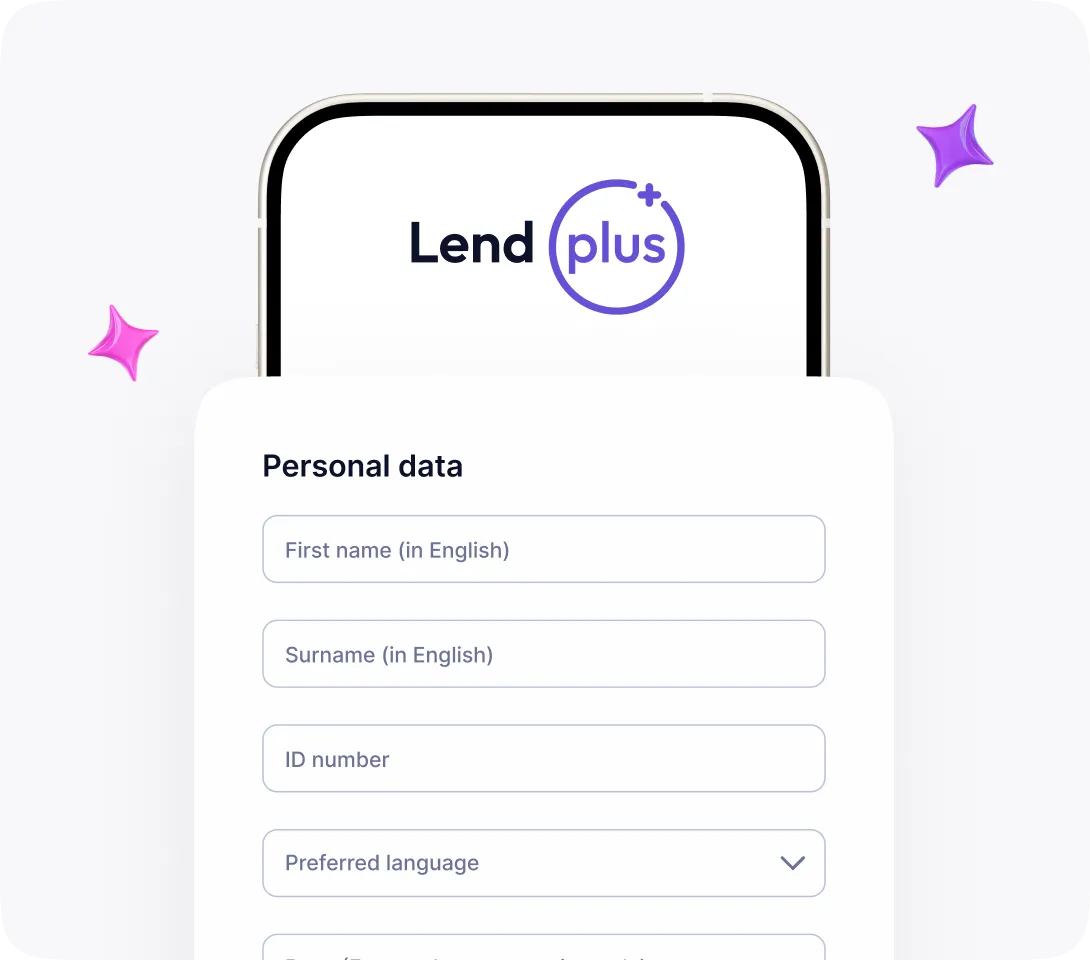

Fill out the client form. It is important to provide complete information otherwise you will not be able to submit your application. After submitting your application, our team will review it. We try to speed up the review process as much as possible.

1. A valid SA ID;

2. Latest 3 months bank statements;

3. A valid cell phone number.

A DebiCheck debit order is a new debit order electronically confirmed by the consumer, with their bank or service provider, on a once-off basis, at the start of a new contract that has been signed up with a company. DebiCheck is a new way in which the consumer can control how certain debit order collections are made from their bank account. DebiCheck ensures that consumers are in control of and aware of debit orders being processed to their bank account. Additionally, it provides the company or service provider that consumers are dealing with, with the comfort of knowing that the consumer has acknowledged and is aware of these debit orders.

PayDay Loans: what it is

The unexpected financial challenges can arise at any moment. Whether it’s a medical emergency, sudden car repairs, or you just need cash urgently. Finding a quick and reliable source of money can be stressful. Fortunately, urgent cash loans provide a solution that can help you access funds in hours. So how do you get a quick and reliable source of money in South Africa?

The LendPlus platform specializes in offering instant cash loans with immediate payout and ensuring that you get the financial relief you need without the usual delays. The platform’s online application process, flexible loan terms, and customer-centric approach make it one of the leading providers of instant cash loans.

With instant money loans, you don’t have to wait for days or weeks for traditional banks to process your application. Instead, you can apply online, get approved quickly, and have the money deposited into your account within a few hours.

Benefits of Urgent Cash Loans from LendPlus

Choosing LendPlus for your fast cash loans offers several key advantages. Here are the top benefits of applying for a loan on this platform:

- Fast Approval

- Flexible Loan Amounts

- Competitive Interest Rates

- No Hidden Fees

- Fully Online Process

How to Apply for an Instant Cash Loan

The platform designed the process to be as user-friendly as possible, ensuring that you can apply without unnecessary complications. Follow these steps:

- Visit the official website and navigate to the loan application section.

- Provide the necessary documents for verification.

- The system will process your request once your application and documents are submitted.

- After accepting the offer, the funds will be transferred directly to your bank account.

How Quickly Can I Get an Instant Money Loan?

In most cases, clients receive their loans on the same day they apply, especially if the application is completed early in the day.

What Is the Maximum Loan Amount I Can Get?

The maximum loan amount you can apply for through LendPlus will depend on several factors, including your credit record, current income, and ability to repay the loan.

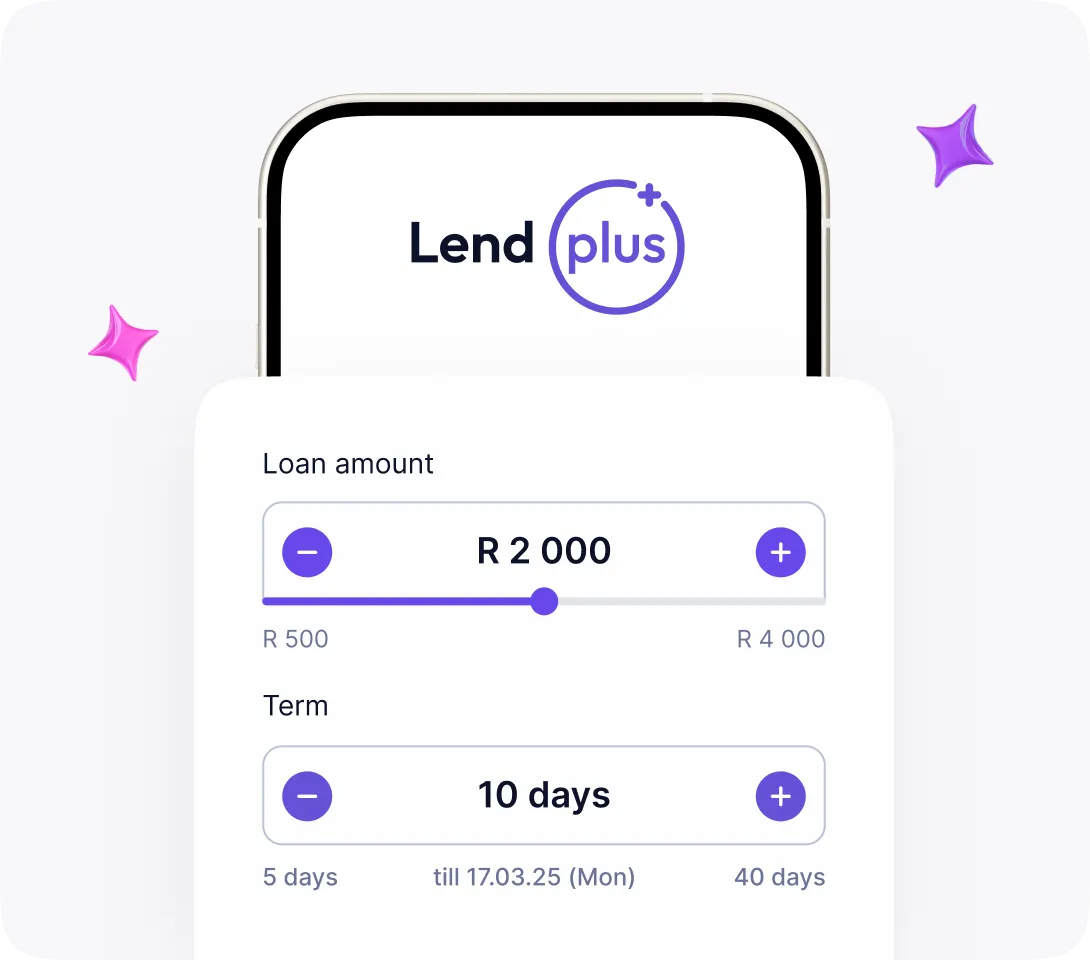

Loan conditions:

- Loan Amount: You can apply for a loan between ZAR 500 and ZAR 4,000.

- Repayment Term: The repayment term typically ranges from 1 to 3 months, depending on the specific loan agreement.

Interest Rate: The annual interest rate (APR) is 36%. Daily rates may apply depending on the duration of the loan.

Fees:

- Initiation fee depends on the loan principal. Example, loan principal = 900R. When the loan is activated the amount of initiation fee is charged in one payment = 15% * loan principal = 0,15 * 900 = 135R;

- Service fee amount = number of days until the end of the month in current month * (60R / number of days in the disbursement month);

- Credit Check: LendPlus may perform a credit check before approving the loan.

- Loan Disbursement: Funds are typically deposited into your account shortly after approval, usually on the same day or the next business day.

Eligibility Criteria for Fast Cash Loans

While LendPlus aims to make urgent cash loans accessible to as many people as possible, there are some eligibility criteria that applicants must meet to ensure responsible lending. These criteria include:

- Age: Applicants must be at least 18 years old to qualify for a loan.

- South African Residency: You must be a legal resident of South Africa with a valid South African ID.

- Proof of Income: To qualify for a loan, you’ll need to demonstrate that you have a stable source of income.

- Credit History: Having a reasonable credit history or demonstrating a reliable repayment capacity will improve your chances of approval.

Repayment Options for Urgent Cash Loans

Repaying your loan on time is essential to maintaining a good financial record and avoiding additional fees. At LendPlus, you can get flexible repayment plans designed to fit your budget. When you take out a loan, your repayment schedule will be clearly outlined in the loan agreement, and you’ll know exactly when and how much you need to pay. Missing payments or late payments can result in additional fees, so it’s important to stay on top of your repayment plan.