Easy steps to get a loan

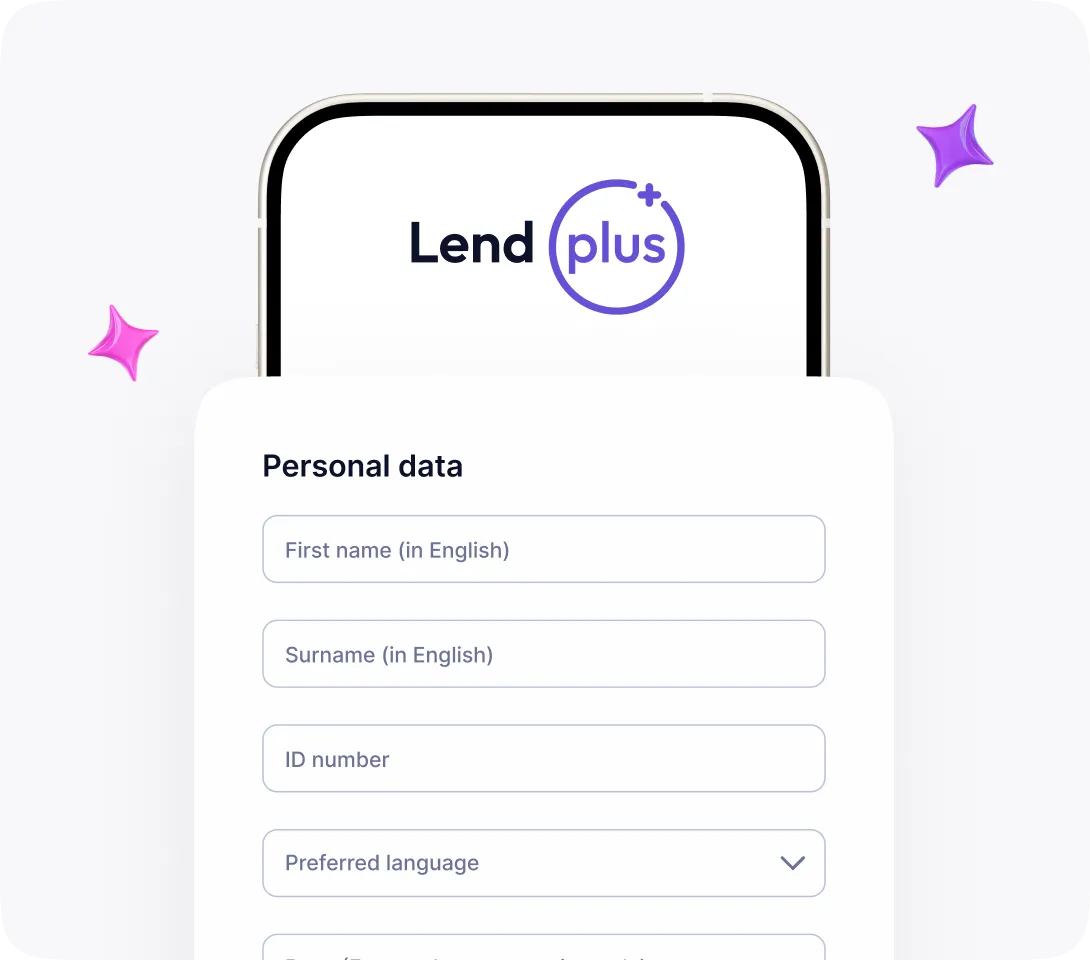

Fill out the client form. It is important to provide complete information otherwise you will not be able to submit your application. After submitting your application, our team will review it. We try to speed up the review process as much as possible.

1. A valid SA ID;

2. Latest 3 months bank statements;

3. A valid cell phone number.

A DebiCheck debit order is a new debit order electronically confirmed by the consumer, with their bank or service provider, on a once-off basis, at the start of a new contract that has been signed up with a company. DebiCheck is a new way in which the consumer can control how certain debit order collections are made from their bank account. DebiCheck ensures that consumers are in control of and aware of debit orders being processed to their bank account. Additionally, it provides the company or service provider that consumers are dealing with, with the comfort of knowing that the consumer has acknowledged and is aware of these debit orders.

PayDay Loans: what it is

Short-term cash loans online: specifics, advantages, criteria, conditions

Short term loan is an opportunity to get quick financial support in the shortest possible time. Cooperation with banking institutions may not always be successful. After all, they have strict requirements to the borrower, and if there are problems with credit history, most likely will refuse to grant a loan. In addition, collateral will be required or the bank may offer a loan for a limited amount and with a short repayment period.

That’s not how Lend Plus works. We always offer short term loan with extended repayment periods and loyal interest rates. For more detailed advice, please call +27 87 107 9722, [email protected].

Which loan is best for short term?

Bank loans are not suitable within the framework of short-term financial services. The fact is that cooperation with them implies only long-term support. After all, the longer the term, the higher the bank’s earnings. If you need only short-term loans, try cooperation with microfinance organizations.

Microloans are loans that are provided by MFIs for a period of up to several months. A loan from Lend Plus is an opportunity to solve financial problems as quickly as possible, for example, to pay for studies or health insurance. If you want to go on a trip, a Lend Plus microloan can help with that.

How to apply for a Lend Plus short term loan?

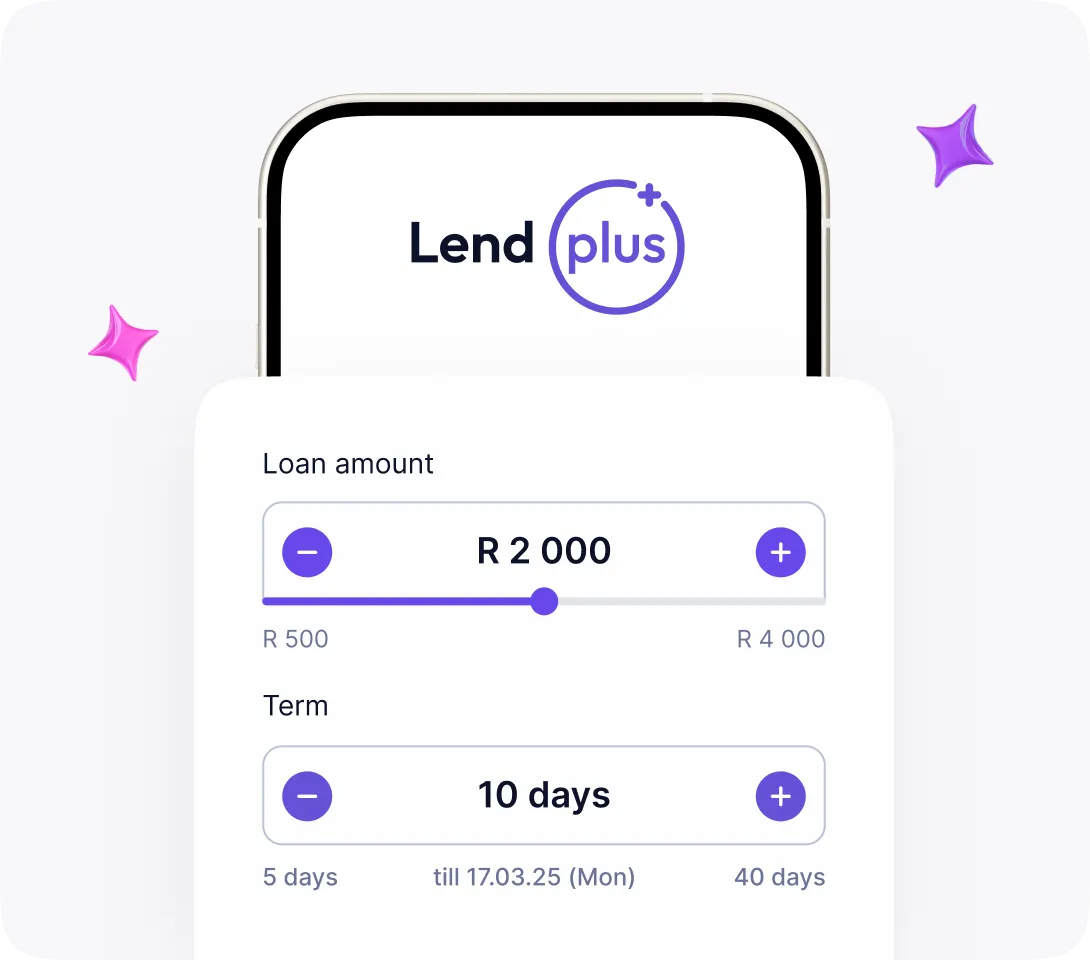

You need to use the loan calculator on the Lend Plus website, selecting the amount of financial support. Next, you need to fill out the registration form, indicating your cell phone number. You will receive an SMS with a code that you need to enter in the account creation field.

After confirming registration, provide contact details, passport information, attach scanned pages of identity documents.

Criteria for a short-term loan application

Lend Plus is a microfinance organization providing short term lending with minimum requirements. First, the borrower must be of legal age – 21 years of age or older. Secondly, the borrower must have valid ID documents and at least a minimum official income.

Are short term loans risky?

Short term loans are a type of loan characterized by higher interest rates. Our microfinance lending organization provides financial support with minimal risks. If you are unable to repay the loan on time, we provide a prolongation.

Conditions of the Lend Plus loan product

Lend Plus is an MFI offering short-term loans up to ZAR 4 000 with interest rate from 0.17% per day. It takes 15 minutes to approve a loan application. After the application is accepted, the system disburses the money to the bank card specified by the client.

The maximum annual interest rate is 60%. The initial commission fee is 15% of the principal amount. Example of calculation of short term lending including commission fee and rate:

A borrower applies for financial support in the amount of ZAR 4000 for up to 90 days at 0.17% per day. The interest for the whole loan term will be ZAR 612 + entrance fee of ZAR 600 . The servicing fee for the money loan will be ZAR 31. The total amount payable is ZAR 5243.

Lend Plus credit counselors will help you calculate the terms of your service right now. Call +27 87 107 9722, get a free consultation right now.

The benefits of short time loans

Lend Plus MFI offers microloans with the possibility of prolongation. Our company has loyal requirements to borrowers, and supports clients with negative credit history.

Why it’s worth applying for urgent cash support with us:

- fast receipt of money to any bank card;

- no need to visit offices – registration is done online;

- ease of applying and a minimum package of documents for the loan;

- accessibility for borrowers with bad credit history;

- increasing the amount of support for regular customers.

Call +27 87 107 9722, write to [email protected]