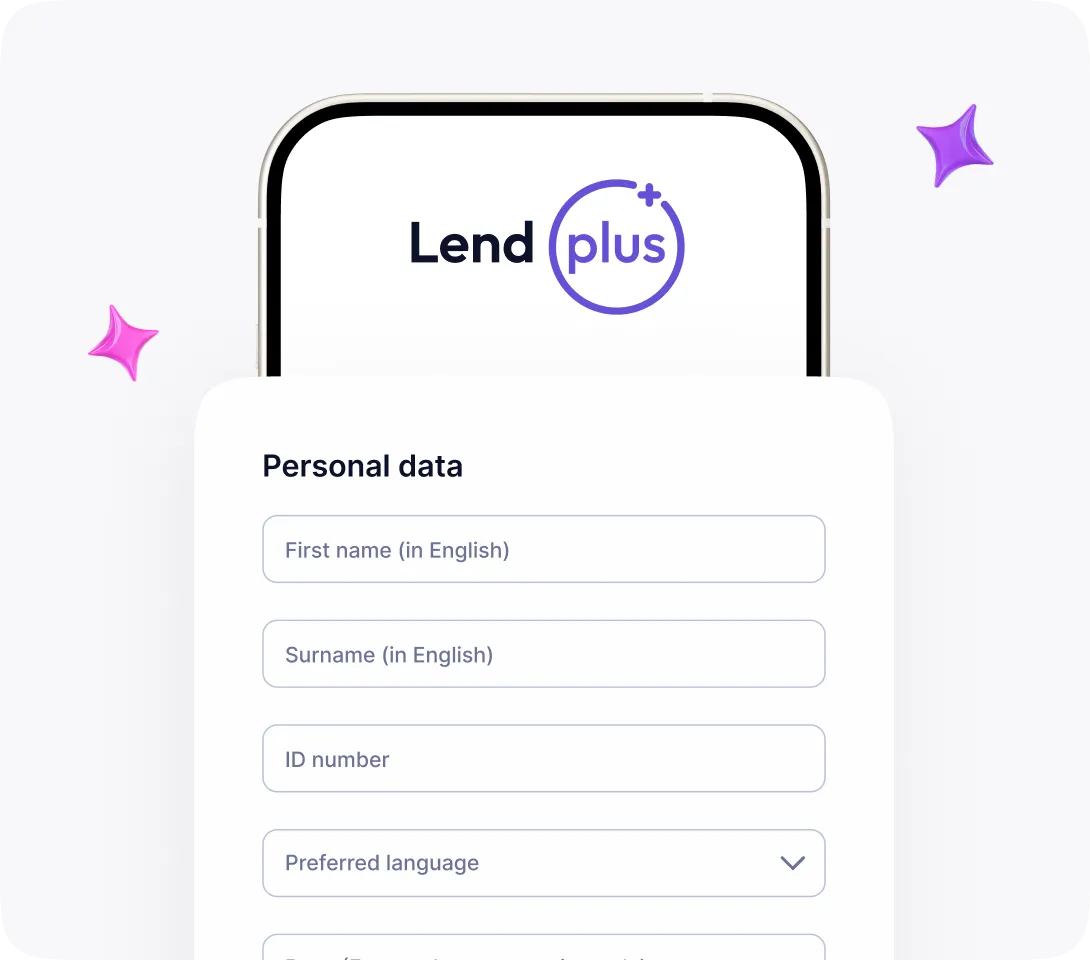

Easy steps to get a loan

Fill out the client form. It is important to provide complete information otherwise you will not be able to submit your application. After submitting your application, our team will review it. We try to speed up the review process as much as possible.

1. A valid SA ID;

2. Latest 3 months bank statements;

3. A valid cell phone number.

A DebiCheck debit order is a new debit order electronically confirmed by the consumer, with their bank or service provider, on a once-off basis, at the start of a new contract that has been signed up with a company. DebiCheck is a new way in which the consumer can control how certain debit order collections are made from their bank account. DebiCheck ensures that consumers are in control of and aware of debit orders being processed to their bank account. Additionally, it provides the company or service provider that consumers are dealing with, with the comfort of knowing that the consumer has acknowledged and is aware of these debit orders.

PayDay Loans: what it is

Quick Loan – best solution for urgent situation

Sometimes, people find themselves in a tough financial situation and need money urgently. Nowadays, many companies offer online loans with minimal credit checks.

However, these easy approvals often come with hidden drawbacks, such as high interest rates. Fortunately, there’s a solution — a quick loan from “Lend Plus”.

What Are Quick Loans?

This loan offers approval within minutes, without the need for special documents or a good credit history. Funds can be received shortly after submitting the application.

However, you have to be cautious, as these loans often come with high interest rates. While a quick loan can solve immediate cash needs, it can also negatively impact your financial situation.

How to Apply for a Fast Loan Online?

Every company offering this service has its own requirements for borrowers, though they are generally quite similar across providers. To get a quick loan, you usually need to:

- submit an application on the lender’s website;

- fill in the form provided;

- specify the card number where the money will be credited;

- receive cash.

You should also specify the exact amount you need. To improve your chances of approval, it’s important not to request large amounts. The entire application process usually takes no more than 10 – 15 minutes, and you’ll receive approval or rejection within a few minutes.

Benefits of Choosing Quick Loans from LendPlus

LandPlus is an online service that provides fast loans to consumers without them having to visit an office or provide a large package of documents.

The application on the lender’s website can be completed in just a few minutes. Once approved, the money is immediately transferred to your account or bank card. This service is available to anyone in need of quick funds, without the need for collateral, lengthy checks, or a complicated registration process.

A key feature of the company is its loyalty to each customer. The company continuously works to improve its lending conditions, ensuring the process is fast and appealing to clients. The company frequently runs promotions and introduces loyalty programs, allowing loans to be offered under the most favorable terms.

Eligibility Criteria for Immediate Loans

To quickly receive the required amount, the borrower needs to provide:

- SA Identificator.

- Bank statements from the past three months.

- A phone number.

Additionally, you will need to complete an application form on the lender’s website.

Quick Loan Repayment Options

The company offers its clients the most convenient options for quick loan repayment. You can repay the loan in the following ways:

- Write-off by debit order. With your consent, the company will automatically deduct the repayment amount from your card. To use this option, ensure the necessary funds are available on the card on the repayment day.

- Online payment. If the client prefers to repay the loan on his own, he can do it himself. It can be done via a link sent by LendPlus to your phone, through your personal account on the lender’s website, or by using the OZOW service.

How Fast Can I Get an Easy Loan?

You can receive a fast loan within an hour during business hours. The company strives to ensure a prompt process, with request processing taking up to two hours.

However, there may be delays in receiving funds, as banks often do not process transactions on weekends. In such cases, the company can transfer funds to the client’s electronic wallet, but this option must be specified when applying for the loan.

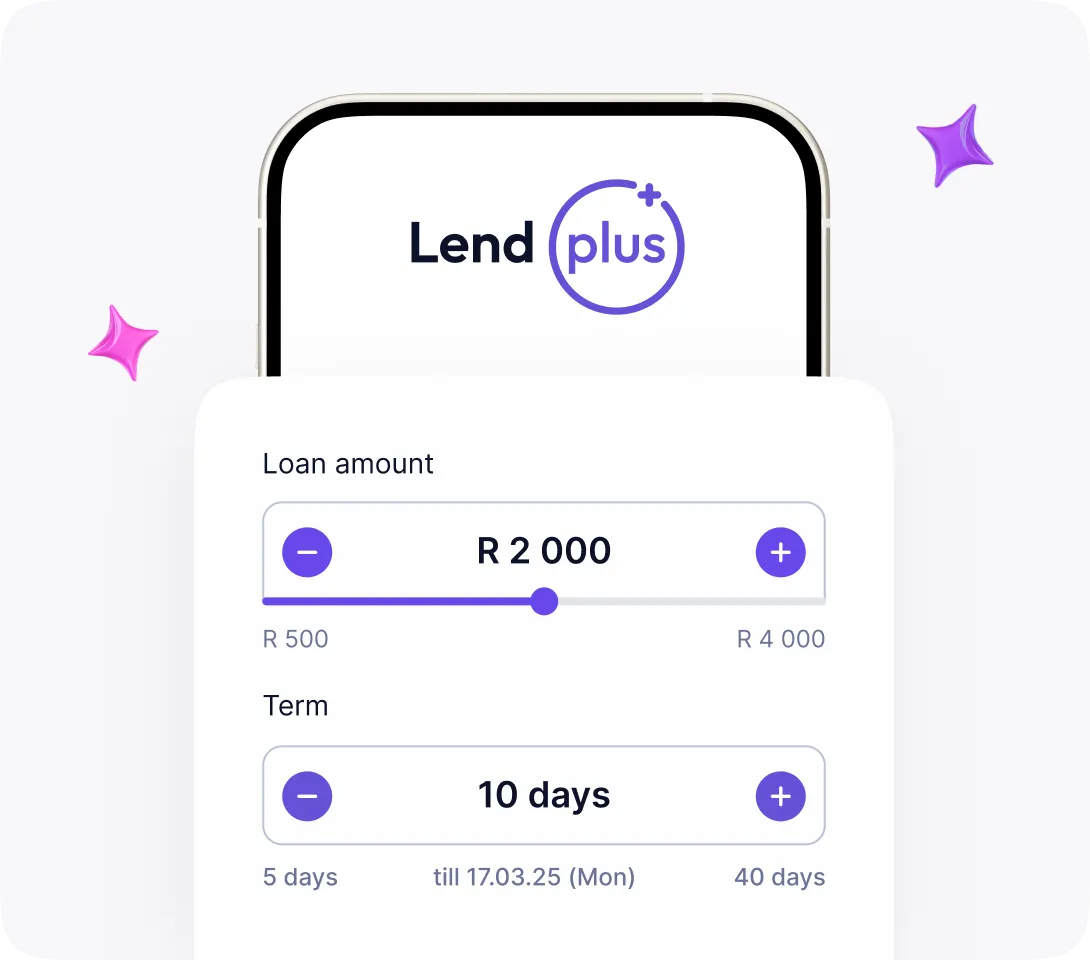

What Are the Interest Rates for Quick Loans?

The company offers a loan product with an annual interest rate of 60%, and loan amounts can range from 500 to 4,000 South African Rand.

When applying for the loan, the client must pay an initial deposit of 15% of the loan amount. Additionally, the client is required to pay a monthly service charge of R60 to the company.

For example, you apply for a loan of ZAR 4000 for 90 days at 0.17% per day, the cost of the loan would be:

- 4000 ZAR principal;

- interest 612 ZAR;

- entrance fee 600 ZAR;

- service fee 60 ZAR.

If the issue date is September 15 (which has 31 days), there are 16 days remaining in the month. Therefore, the calculation is: 16*(60 / 31) = 31 ZAR. The total amount is 5,243 South African Rand.

Are There Any Fees Associated with Instant loans?

Every loan company charges a fee for its services, which may include maintaining the borrower’s personal account. The commission amount is determined on a case-by-case basis.

Tips for Getting Approved for a Quick Loan

There are a few simple steps you can take to improve your chances of securing a loan. Since some of these steps may take time, it’s advisable to address the situation before you actually need the funds.

- Apply for the exact amount you need. The larger the loan amount, the more challenging it may be to get approved. Additionally, the loan amount can influence which lenders consider your application; for instance, some companies may not lend more than $500. For larger loans, you’ll often need to provide collateral, such as a vehicle or real estate, and these loans typically come with higher interest rates.

- Improve your credit history, as this factor directly impacts which lenders are willing to work with you. The terms and conditions of the loan, as well as the required documentation, may vary based on your credit history. Therefore, it’s crucial to enhance your credit score in advance. You can quickly and significantly improve your rating by consistently receiving positive evaluations from the banks where you have borrowed money.

- A reputable lender is essential. Before submitting an application, it’s important to thoroughly research banks or companies that offer fast loans, selecting those with a strong reputation. This includes factors such as a customer-friendly approach, competitive interest rates, reasonable repayment terms, and the option to extend the loan.

- Prepare the necessary documents. Some lenders may also require additional paperwork, such as a proof of income or verification of your residential address (like utility bills).

If you take care of these things in advance, you can greatly increase your chances of getting a quick loan.

Apply for a Quick Loan Now!

The entire loan application process with us is quick and straightforward! Our company values each client, providing the best loan terms available. If you’re looking for a favorable and fast loan, reach out to us today!