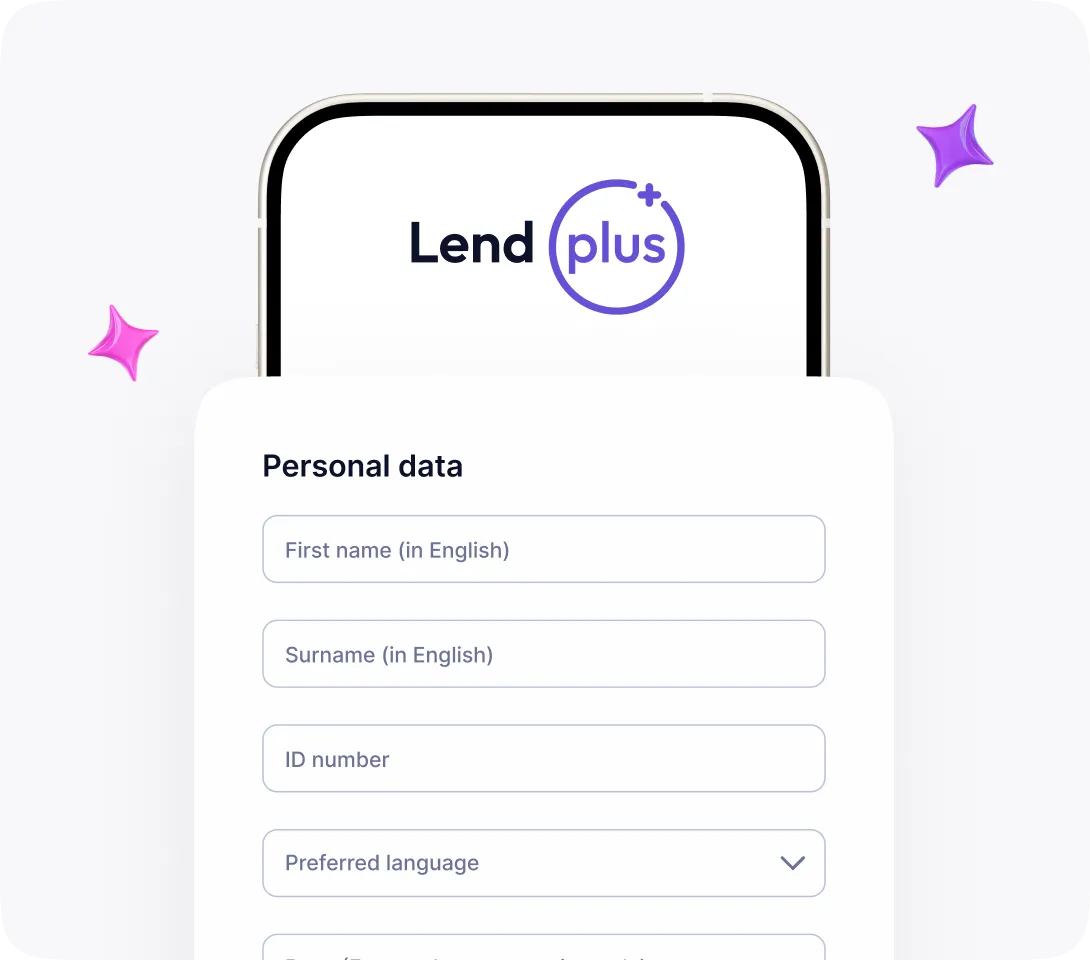

Easy steps to get a loan

Fill out the client form. It is important to provide complete information otherwise you will not be able to submit your application. After submitting your application, our team will review it. We try to speed up the review process as much as possible.

1. A valid SA ID;

2. Latest 3 months bank statements;

3. A valid cell phone number.

A DebiCheck debit order is a new debit order electronically confirmed by the consumer, with their bank or service provider, on a once-off basis, at the start of a new contract that has been signed up with a company. DebiCheck is a new way in which the consumer can control how certain debit order collections are made from their bank account. DebiCheck ensures that consumers are in control of and aware of debit orders being processed to their bank account. Additionally, it provides the company or service provider that consumers are dealing with, with the comfort of knowing that the consumer has acknowledged and is aware of these debit orders.

PayDay Loans: what it is

Cash loans can be very helpful and supportive for individuals facing unexpected financial challenges. When you ask yourself “Where can I find cash lenders near me who can offer fast, short-term financial solutions?”, LendPlus is the platform you’re looking for.

What Is a Cash Loan?

A cash loan is a short-term, unsecured loan designed to provide quick access to funds for individuals in need. Unlike traditional bank loans, online cash loans are processed quickly, with minimal paperwork, allowing you to get the money you need within hours.

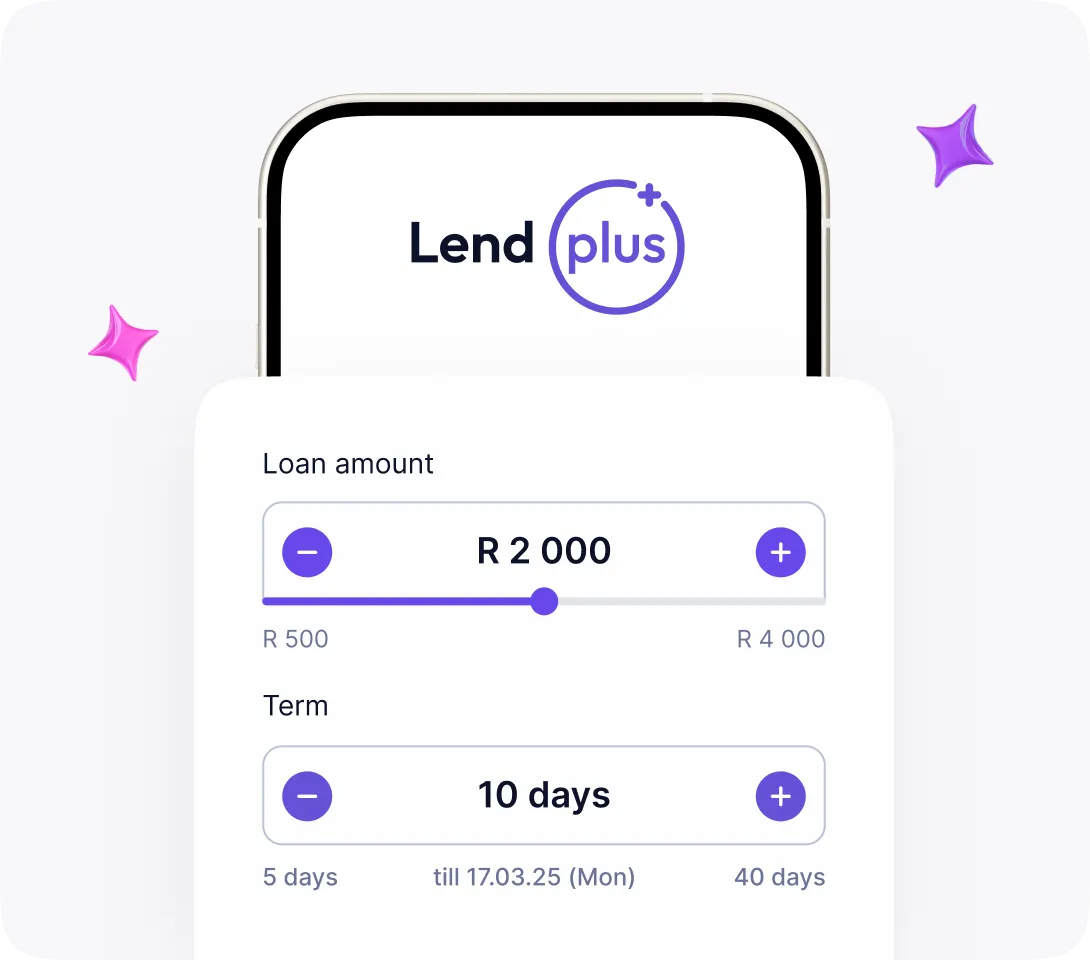

How Much Can I Borrow?

The loan amount you can borrow with LendPlus ranges from ZAR 500 to ZAR 4,000. This flexibility allows you to choose an amount that suits your specific financial needs without borrowing more than you can repay.

What Are the Interest Rates for Cash Loans?

LendPlus offers a competitive Annual Percentage Rate (APR) of 60%. This rate is applied over a calendar year, ensuring transparency in the interest calculations. Other fees are associated with the loan, including an initiation fee of 16.5% of the principal amount and a service fee based on the number of days remaining in the month when the loan is disbursed.

For example, if you apply for a ZAR 4,000 loan for 90 days under a 0.16% daily interest rate, here’s how the total cost would break down:

- Principal: ZAR 4,000

- Interest: ZAR 612

- Initiation fee: ZAR 600

Service fee: Calculated based on the number of days remaining in the disbursement month. If the loan is issued on September 15th, with 16 days remaining in the month (31 days total), the service fee would be:

16 * (60 / 31) = ZAR 31

Total cost of the loan: ZAR 5,243

Benefits of Cash Loans Online from LendPlus

When you choose LendPlus for your cash advance loan, you gain access to several key benefits:

- Fast Approval: The application process is quick, so you can receive approval within minutes.

- Flexible Loan Amounts: Borrow between ZAR 500 and ZAR 4,000, depending on your financial needs.

- No Hidden Fees: LendPlus is transparent about its fees, so you’ll know exactly what you’re paying for.

- Fully Online Process: You can complete the entire loan application process online, without a requirement for in-person visits or extensive paperwork.

- Same-Day Funding: Once approved, your funds are typically disbursed within a few hours, making it a convenient solution for urgent financial needs.

To ensure responsible lending, LendPlus has established the following eligibility criteria for its cash loans:

- Age: You must be 18 years old or above.

- Residency: Applicants must be legal residents of South Africa with a valid South African ID.

- Proof of Income: You must demonstrate a stable source of income.

- Credit History: While a perfect credit score is not mandatory, having a reasonable credit history improves your chances of approval.

Cash Loan Repayment Options

LendPlus provides flexible repayment options to accommodate different financial situations. You can choose to repay your loan in weekly, bi-weekly, or monthly installents. The repayment schedule is clearly outlined in the loan agreement, helping you stay on track and avoid any late fees.

How Quickly Can I Receive the Funds?

One of the standout features of LendPlus is the speed at which funds are disbursed. Once your loan application is approved, the money is transferred directly into your bank account. In most cases, clients receive their funds on the same day, especially if they apply early in the day.