LendPlus advantages

The loan app

Easy steps to get a loan

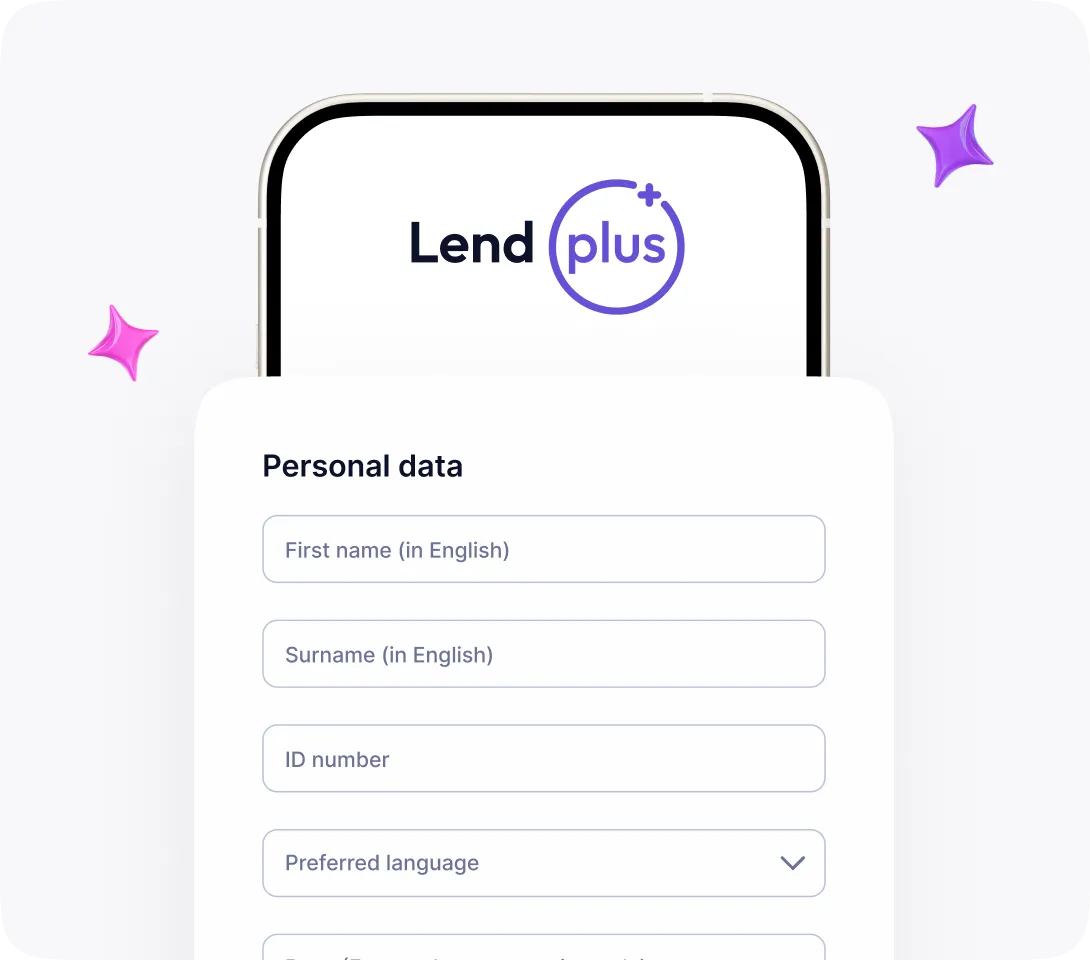

Fill out the client form. It is important to provide complete information otherwise you will not be able to submit your application. After submitting your application, our team will review it. We try to speed up the review process as much as possible.

1. A valid SA ID;

2. Latest 3 months bank statements;

3. A valid cell phone number.

A DebiCheck debit order is a new debit order electronically confirmed by the consumer, with their bank or service provider, on a once-off basis, at the start of a new contract that has been signed up with a company. DebiCheck is a new way in which the consumer can control how certain debit order collections are made from their bank account. DebiCheck ensures that consumers are in control of and aware of debit orders being processed to their bank account. Additionally, it provides the company or service provider that consumers are dealing with, with the comfort of knowing that the consumer has acknowledged and is aware of these debit orders.

What people say about us

PayDay Loans: what it is

There are situations in life when you need money urgently, for example, to pay for housing and utilities or repair equipment, but your paycheck is still far away. In such cases, payday loan becomes an effective assistant. A short-term loan allows you to get urgent monetary support, then quickly repay the loan with minimal interest.

There is an easy way to get a payday loan – apply to the Lend Plus credit company.

The MFI imposes requirements on clients in strict accordance with financial legislation. There is also an extension.

For detailed advice, please contact us:

The managers of the financial company will select the optimal loan for your needs

What Are Payday Loans?

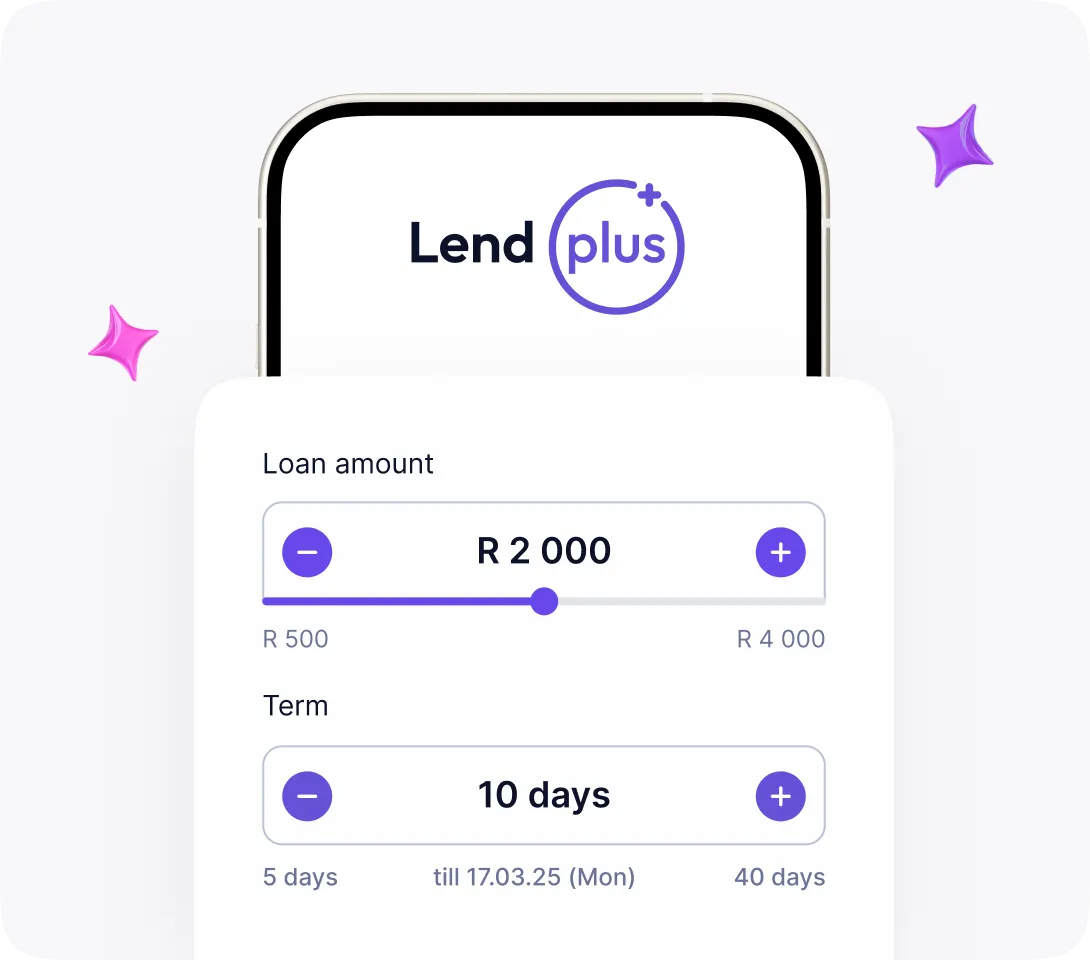

This loan option is a variation of urgent financial support, which provides for disbursement of a small amount for a short period of time. The volume of the microloan does not exceed 4000 ZAR at the first application. The purpose of this type of loan is to provide quick funds to address urgent needs, such as paying for education, insurance, travel, or repairs to equipment or a car before the next paycheck.

Unlike bank loan products, applications for payday advance online from microfinance organizations is processed much more quickly. The approval process takes at least 15 minutes.

How to Apply for a Payday Loan Online?

To begin with, it is necessary to use the loan calculator, selecting the amount of necessary monetary support. Next, the MFI system will offer to fill in the application form, in which it is necessary to specify personal information, namely full name, age, status, cell phone number, e-mail. The next step is to attach documents confirming identity, payment data – bank card or account number.

After registration and filling in the application form, the system of the microfinance organization will check the borrower’s compliance with the MFI’s requirements. It takes up to half an hour and if everything is fine, the money comes to the bank card within 5-10 minutes.

Eligibility Criteria for Payday Loans in South Africa

Lend Plus finance company provides requirements to the borrower, which makes it easy to get urgent credit support. Here are the main criteria that a borrower must meet in order to receive non-bank financial support:

· be of legal age;

· have a basic income for the last 3-4 months what is required when providing a bank statement;

· provide a valid cell phone number and SA ID.

After collecting the information, we check whether it is possible to provide a loan.

The non-banking loan service caters to customers of all income levels. You can get a personalized offer by calling:

Benefits of Payday Loans from LendPlus

One of the main advantages is the speed of processing. Traditional loans involve a rigorous screening of the borrower, which takes up to several days. If the financial institution deems the client unsuitable, service may be declined. Payday loans also carefully evaluate the credit history, but the deadline for completing the application and the process of checking the client is much shorter.

Differences between a loan from an MFI and a bank loan:

· you can get payday lenders online without leaving home. You do not need to visit the office to get urgent support. Just go to the company’s website, provide all the necessary documents and proof of income through the online form;

· minimal requirements. To get a microloan, you do not need guarantors or collateral;· accessibility. Loan support is provided to a wide range of people who meet the requirements for the borrower.

The LendPlus financial company provides convenient ways to repay the loan, in addition to the standard debit of funds from the account. You can repay the loan with the possibility of prolongation by paying interest.

Payday Loan Repayment Options

The Lend Plus microcredit organization offers several options for repaying loan obligations. The company allows you to enable automatic repayment. To do this, it is necessary to replenish the bank account with the required amount. After that, debit deduction will be organized.

If you need to repay payday advance loans online before the end of the loan agreement, you can use the OZOW payment system. This EPS is an official partner of the company. How to do it:

· go to the personal account on the website of the microfinance organization;

· click on Repay Online;

· use the link that the company will send by SMS or e-mail.

Next, it is necessary to select a bank. The following step is to confirm the payment. Repayment of the loan is carried out instantly.

Apply for a Payday Loan Today!

Unexpected circumstances can arise in life that are difficult to manage without a financial cushion. However, our lending company, Lend Plus, is here to help, providing you with the necessary funds as quickly as possible.

We do not ask you about the purpose of using the loan – you decide what to use the non-bank loan for. Our goal is to be as customer-oriented as possible, so we understand that in emergency situations there is no time to collect a large package of documents.

What you need to do to have the money now:

· use the loan calculator – choose the amount of money you need, fill out the application;

· attach identity documents or verify your identity via SA ID;

· receive the funds on the bank details you have specified.

If you need money urgently, help is just a call away. Contact us at +27 87 107 9722, fill out a financial support application, and the funds will be sent to your bank card or account immediately.